Why is there no US rival to compete with Huawei?

Please use the sharing tools found via the share button at the top or side of articles. Copying articles to share with others is a breach of FT.com T&Cs and Copyright Policy. Email licensing@ft.com to buy additional rights. Subscribers may share up to 10 or 20 articles per month using the gift article service. More information can be found here.Huawei is the world’s biggest telecoms equipment maker, with a 28 per cent market share — according to Dell’Oro, the market research company — and more 5G contracts around the world than any other company. Its closest rivals are Ericsson and Nokia, the European companies. But there is no US group that can build the equipment to transfer signals between mobile phones and the towers or sites that make up the network. “This is a serious problem, and one that we probably engineered over a long period of time,” said Robert Mayer, senior vice-president of cyber security at the industry group US Telecom. “Now that Huawei has captured the level of market share they have, and with more recognition of the security concerns that poses, a lot of people are asking, ‘How did this happen?’”

Please use the sharing tools found via the share button at the top or side of articles. Copying articles to share with others is a breach of FT.com T&Cs and Copyright Policy. Email licensing@ft.com to buy additional rights. Subscribers may share up to 10 or 20 articles per month using the gift article service. More information can be found here.

“US vendors got very powerful and strong in the old landline world,” said Dan Hesse, a former chief executive of Sprint and before that of AT&T Wireless. “But because of that, it was difficult for them to make the change aggressively and quickly enough towards the mobile and internet future.” Industry veterans say that supremacy disintegrated because of choices made during the 1990s, both by government and the companies themselves. In 1996, the US passed a Telecommunications Act, which prompted a flurry of new entrants into the market. But some say the battle that followed left large US telecoms equipment makers — such as Lucent, which was spun out of AT&T and included Bell Labs — financially stretched, and the market as a whole fragmented. Tom Lauria, a telecoms analyst and former director at Lucent, said: “After the Telecoms Act of 1996, we had a massive number of entrants into the market. To keep them going, we would finance almost everything they bought until they became mature enough to pay the money back. This was not a sustainable model.” Others point out that the 1996 act allowed companies to develop and use their own network technologies, while in Europe companies all agreed to use GSM, which became the worldwide standard for mobile communications. At the same time, said Mr Lauria, companies such as Lucent were also looking to sell into the fast-growing Chinese market, helping keep revenues afloat, but also sewing the seed for China’s eventual domination. “Whenever we sold to the Chinese, they would demand that we manufacture locally and that we hand over the technology to our Chinese partners,” he said. “Western companies needed the revenue growth, and that meant we had to play by their rules.”

Please use the sharing tools found via the share button at the top or side of articles. Copying articles to share with others is a breach of FT.com T&Cs and Copyright Policy. Email licensing@ft.com to buy additional rights. Subscribers may share up to 10 or 20 articles per month using the gift article service. More information can be found here.

In the end, Lucent was bought by France’s Alcatel in 2006. Nokia Siemens Networks bought Motorola’s network infrastructure division in 2011, before going on to purchase the combined Alcatel-Lucent in 2015. Until recently, what some in the sector see as a commercial failure by US companies was not a political problem. But with the imminent roll-out of 5G, many in President Donald Trump’s administration are worried that the US will fall behind further. As a result, some are promoting unlikely solutions, such as getting the US government to develop and build 5G networks instead. “To get to 5G in America, you need to go to the defence department,” Newt Gingrich, the Republican former speaker of the House of Representatives, recently told a conference in Washington. Others, however, are urging Mr Trump to accept the reality that much of the world’s 5G equipment will be built outside the US, and to compel allies to use European products rather than cheaper Chinese ones. “The cost of replacing an entity on the scale of Huawei would be prohibitive,” said Mr Mayer. “The genie is already out of the bottle.”

華為任總裁幾個月前就說了:

美國電機電子學會IEEE有近百種技術雜誌。此份雜誌屬通俗層級:這篇說美國軍方控制頻寬分享,導致民間的5G技術選擇了"劣"於華為科技等中方公司的,讓中方技術成為"事實的標準",便宜又"好",將雄霸世界。呼籲:胡不投降,奔向敵營......

"...But the U.S. military’s premier advisory board of academic researchers and private sector technologists has warned that China’s front-runner position means it will likely win much of the world’s business in deploying 5G infrastructure and services. With that in mind, it has advised that the United States would be wise to adopt a strategy akin to “if you can’t beat ‘em, join ‘em.”...The United States may not like it. But that’s what it’s going to take to make the best of living in China’s 5G world."

----

最新一期的經濟學人評論指出,如果要舉出一個例子形容中國之崛起,沒有比華為電信本身之崛起更為貼切。華為一如中國,兩者之冒起同時引起世界其他地方的憂慮,西方對華為在5G技術的版圖擴張,尤其是它對西方的安全所可能造成的威脅,反應可說是從“煩厭到極端的敵意”。但經濟學人表示,華為在西方仍在吵吵鬧鬧之際卻繼續壯大,而英國最近對華為之欲拒還迎,不管是真心還是假意,華為已視之為得勝者的“頂上的另一根羽毛”。

---

How the U.S. Can Prepare to Live in China’s 5G World

China's first-mover advantage in deploying 5G networks capable of transforming national economies has major implications for the United States

Advertisement

If you believe the triumphalist messaging from U.S. President Donald Trump’s White House and from the U.S. telecommunications industry, the United States is racing neck and neck with China in a global competition to roll out speedy 5G mobile networks. But the U.S. military’s premier advisory board of academic researchers and private sector technologists has warned that China’s front-runner position means it will likely win much of the world’s business in deploying 5G infrastructure and services. With that in mind, it has advised that the United States would be wise to adopt a strategy akin to “if you can’t beat ‘em, join ‘em.”

Unlike earlier generations of mobile networks based on voice and texting services, 5G networks could deliver connection speeds of up to 20 gigabits per second and enable smartphone owners to download high-definition movies in less than a second. Data transmissions with less than a millisecond of delay would also set the stage for new services that allow self-driving cars to make AI-powered decisions through near-instantaneous communication with cloud computing servers. The country that rolls out the first national 5G network could also dominate internationally by selling 5G equipment and services to other countries that have lagged behind.

“[T]hat country is currently not likely to be the United States.” said an April 2019 report issued by the U.S. Defense Innovation Board, a group of scientists and Silicon Valley leaders serving as advisers to the Pentagon.

The group describes China, Japan, South Korea, and the United States as the leading contenders in developing and deploying 5G networks, with European countries such as the UK, Germany, and France forming a “second-tier.” But China, they say, will likely enjoy a “first-mover advantage.”

That much seems clear despite plenty of hype and confusion in dueling claimsabout who was first to deploy 5G and what that means. Recent headlines have focused on deployments of non-standalone 5G: enhanced mobile broadband that piggybacks off of the existing 4G LTE networks and could enable a tenfold increase in download speeds for mobile devices. Major telecoms in the United States and elsewhere have begun deploying these non-standalone 5G services, which are more evolutionary than revolutionary—a fact that the Pentagon advisory board’s report emphasized by calling out 5G marketing claims.

Despite messaging from various marketing initiatives in the United States, very little U.S. territory has seen deployment of 5G infrastructure that can deliver 1 Gbps or even 100 megabit per second service at the edges of coverage. Whereas LTE deployment resulted in 10x end user speed improvement across large parts of the United States, carriers to date have not demonstrated deployment capability that would deliver high speeds to large parts of the U.S. population.

China’s first-mover advantage will come into play with the upcoming phase of 5G network deployment, according to a 2018 report by the Eurasia Group, a political risk consultancy headquartered in New York City. It’s part of China’s plan to establish commercial standalone 5G networks by 2020, which is at least several years ahead of the United States and other competing nations that have set 2025 as their target date.

That 5G rollout, which will require hefty investments in new infrastructure such as antennas and base stations, will enable some of the truly exciting applications and services that require near-instantaneous communications among possibly billions of new sensors and devices connected through the “Internet of Things.”

China has already made $180 billion in capital expenditures for 5G deployment over the past five years, installing about 350,000 5G-operable base stations, which is nearly 10 times the number currently deployed in the United States. Beyond China’s shores, Chinese telecom giant Huawei has also shipped 70,000 base stations and signed 40 contracts to sell 5G equipment in Europe, the Middle East, Asia, and Africa.

This head start will also give China an early lead in developing and deploying smarter cities, self-driving cars, and automated factories, says the Eurasia Group report. The opportunity to test new applications and use cases could in turn attract business from other countries that are looking to supply their own citizens with similar 5G-enabled applications and services.

That being said, the Eurasia Group expects U.S. companies to remain highly competitive and perhaps retain an edge in innovation over their Chinese counterparts when it comes to developing similar applications and services. What’s more, Chinese companies currently rely on a few U.S. companies that manufacture crucial hardware components for deploying 5G networks.

But the United States still faces a crucial decision at home that has huge consequences in a world already likely to lean toward China’s 5G leadership. It’s a fork-in-the-road choice between favoring either high frequencies or low frequencies for 5G networks—a spectrum availability decision that will greatly impact whether all those promises about 5G yielding faster download speeds and lower latency will be fulfilled.

The United States currently favors millimeter wave (mm-wave) transmission, with high frequencies between 30 and 300 gigahertz. The shorter wavelengths in this range make for narrower beams that boost both the resolution and security of data transmissions. But they come with significant downsides, including limited range and an inability to penetrate obstacles such as walls and human bodies.

The short-wavelength route would require U.S. telecoms to build a very dense—and expensive—network of 5G base stations throughout any city or other geographic area to ensure reliable connectivity. The Defense Innovation Board report also cast some doubt on whether U.S. telecoms can absorb the cost of installing the infrastructure necessary for a full mm-wave network.

China’s has taken the opposite approach. It favors low-frequency transmission, primarily in the 3- and 4-GHz bands. This strategy enables Chinese telecoms to swiftly roll out broad 5G coverage with fewer base stations because the wavelengths in these bands are able to penetrate obstacles.

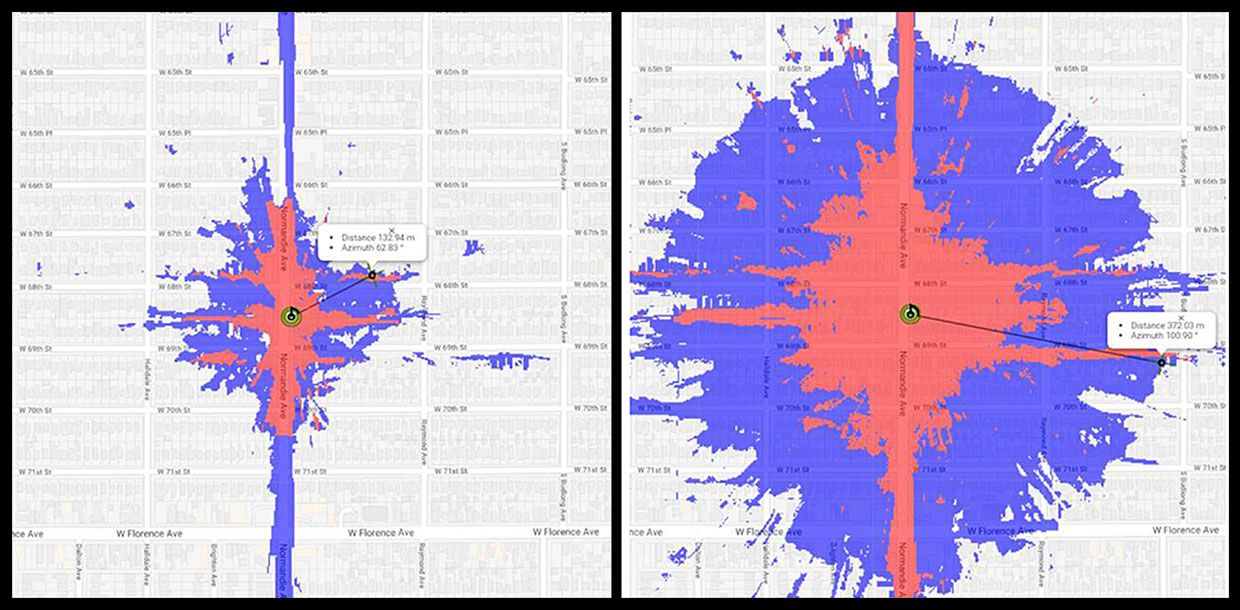

The Defense Innovation Board enlisted Google’s help in performing a field study pitting the mm-wave configuration standard used in U.S. 5G testing against a sub–6 GHz configuration standard used in Chinese 5G deployment. The mm-wave coverage would likely provide edge speeds of 100 Mbps to less than 12 percent of the U.S. population, whereas the sub-6 approach would deliver 100-Mbps transmission speeds to more than 57 percent of the population.

The mmWave approach gave gigabit-per-second transmission speeds to less than 4 percent of Internet users, whereas the sub-6 approach gave 21 percent of the population Gbps coverage. The preliminary study did not even take into account possible blocking of mm-wave signals by human bodies and vehicles, which would further reduce a network’s effectiveness.

Despite the sub-6-gigahertz setup’s advantages, U.S. telecoms and the U.S. Federal Communications Commission (FCC) still seem to favor the mm-wave approach. That’s largely because the U.S. government owns large chunks of the sub-6 spectrum and restricts commercial use of those bands. And it’s currently unclear whether the U.S. government will be willing to share or auction off even a sliver of it.

In most other countries, commercial access to the sub-6 spectrum isn’t impeded in this way. So, it’s reasonable to predict that China’s first-mover advantage could translate into most everyone else adopting its 5G equipment and services tailored for those low-frequency bands. If the United States continues to prioritize mm-wave deployment, U.S. telecoms and tech companies would face an uphill battle in trying to sell 5G equipment and services abroad.

Dominance on the technology front also has geopolitical consequences. There are magnified security risks as national economies become heavily dependent upon 5G networks featuring networking equipment that may be studded with backdoors or other security vulnerabilities.

The prospect of a 5G world dominated by Chinese companies poses special concerns for the U.S. military, which maintains a global presence. U.S. military forces deployed overseas might find themselves sending transmissions across 5G networks that have Chinese equipment embedded throughout. “This would pose a serious threat to the security of DoD operations and networks going forward,” said the Defense Innovation Board report.

Citing national security concerns, the Trump administration has been urging U.S. allies to ban Chinese companies from supplying equipment to their 5G networks. In particular, the Chinese telecom Huawei has come under intense scrutiny for supposed links to Chinese state security, despite the company’s forceful and repeated denials. Several countries such as Australia, New Zealand, and Japan have already banned or severely restricted Huawei from participating in their build outs of 5G networks.

The U.S. campaign to limit China’s 5G influence raises the risk of creating a bifurcation in the world’s 5G implementation. That 5G divide could impact costs for user and infrastructure equipment due to “lower economies of scale and higher transaction costs,” according to the Eurasia Group report.

Both the Eurasia Group and the Pentagon’s advisory board point out that Chinese equipment is frequently not just cheaper but also superior to that of Western rivals. The United States cannot even offer any major U.S. alternatives for certain wireless networking equipment in a market dominated by Huawei. And banning Huawei equipment would cost both time and money for many countries eager to deploy 5G networks—especially if they would need to remove Huawei equipment already installed in their mobile infrastructure.

Even staunch U.S. allies such as the UK, France, Germany and Poland have thus far held off on pronouncing blanket bans on Huawei equipment. In March, the European Commission pointedly ignored the U.S. call for a blanket ban despite requiring European Union countries to share data on 5G security risks.

So what is the United States to do in the face of the Chinese sub-6 approach likely becoming the global standard for broad area networks? The Pentagon’s advisory board recommends that the U.S. government pivot away from the mmWave approach and demonstrate that by taking the bare minimum initial step of requiring the U.S. Department of Defense to share some of its 500 megahertz of space in the 4-GHz band.

The board also suggests that the United States encourage allies to adopt trade policies that use tariffs on goods from any country found to have backdoors or security vulnerabilities. This is a backhanded way of encouraging all companies to tighten up security on their products. The experts also recommend that the U.S. continue to ask allies to ban the use of equipment produced by Chinese state-owned businesses in their 5G network deployments.

But the most eye-catching recommendation is that the U.S. military must face facts: It has to learn to operate in a “post-Western” wireless ecosystem dominated by Chinese companies and assume that all network infrastructure will ultimately become vulnerable to cyberattacks. “Zero-trust” networks with multiple security checks before gaining access to information will need to become the Pentagon’s modus operandi. All military networks will need both added resiliency and added layers of redundancy.

The United States may not like it. But that’s what it’s going to take to make the best of living in China’s 5G world.

沒有留言:

張貼留言